A PRINTABLE BUDGET PLANNER MADE FOR CARD SPENDERS LIKE YOU!

Get out of the apps and budget by hand!

Connect with your Spending better

The Canadian Budget planner is printable, and designed specifically for digital savvy spenders who want to take control of their finances without having to use cash!

Are you tired of overspending on your credit cards and not knowing where your money is going? Do you want to create a budget that works for your credit card spending habits? Our printable budget planner is here to help!

Write it down to make it happen!

Writing by hand is proven to leave a larger impact in your memory than entering it in your phone or typing it in the computer.

This is why a paper-based budget is so effective. Become more mindful of your spending habits, and how much you spend. When you write down your goals, and your habits you are more likely to be able to reach them!

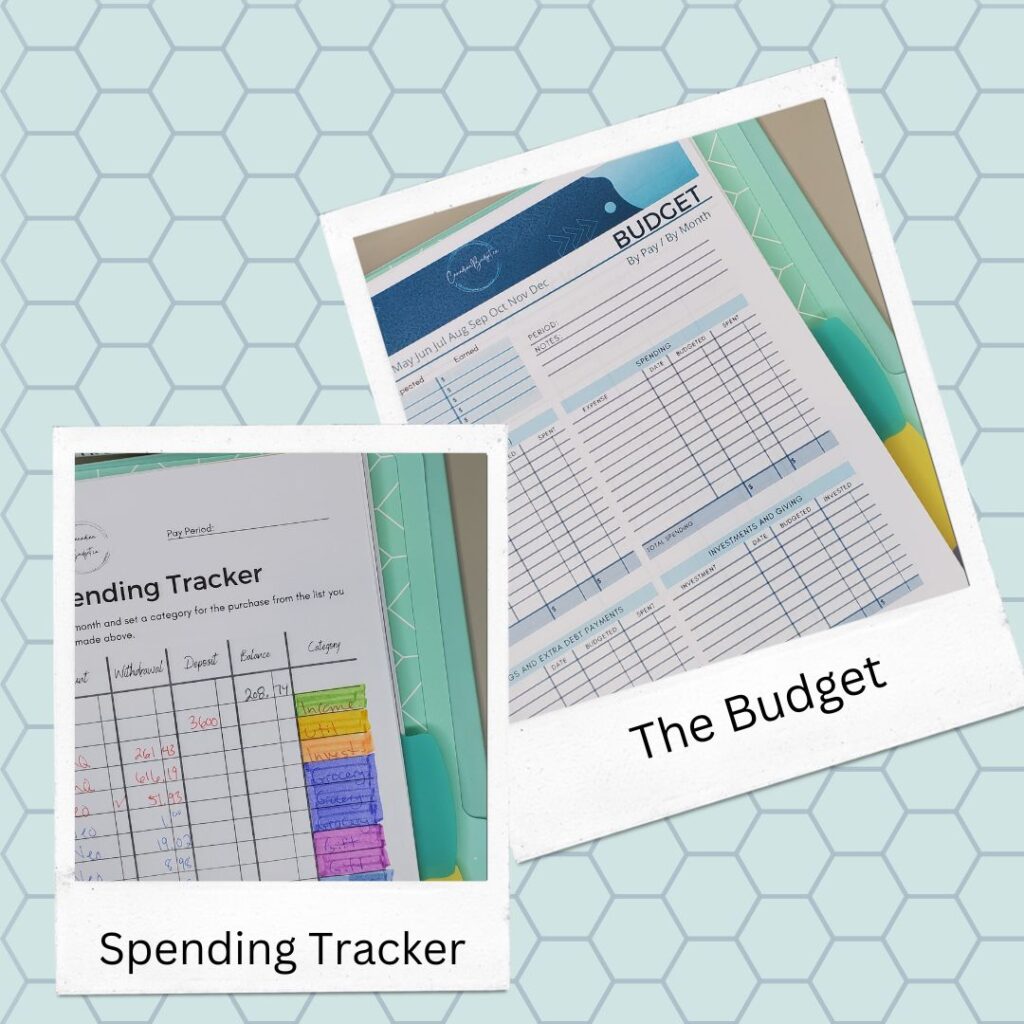

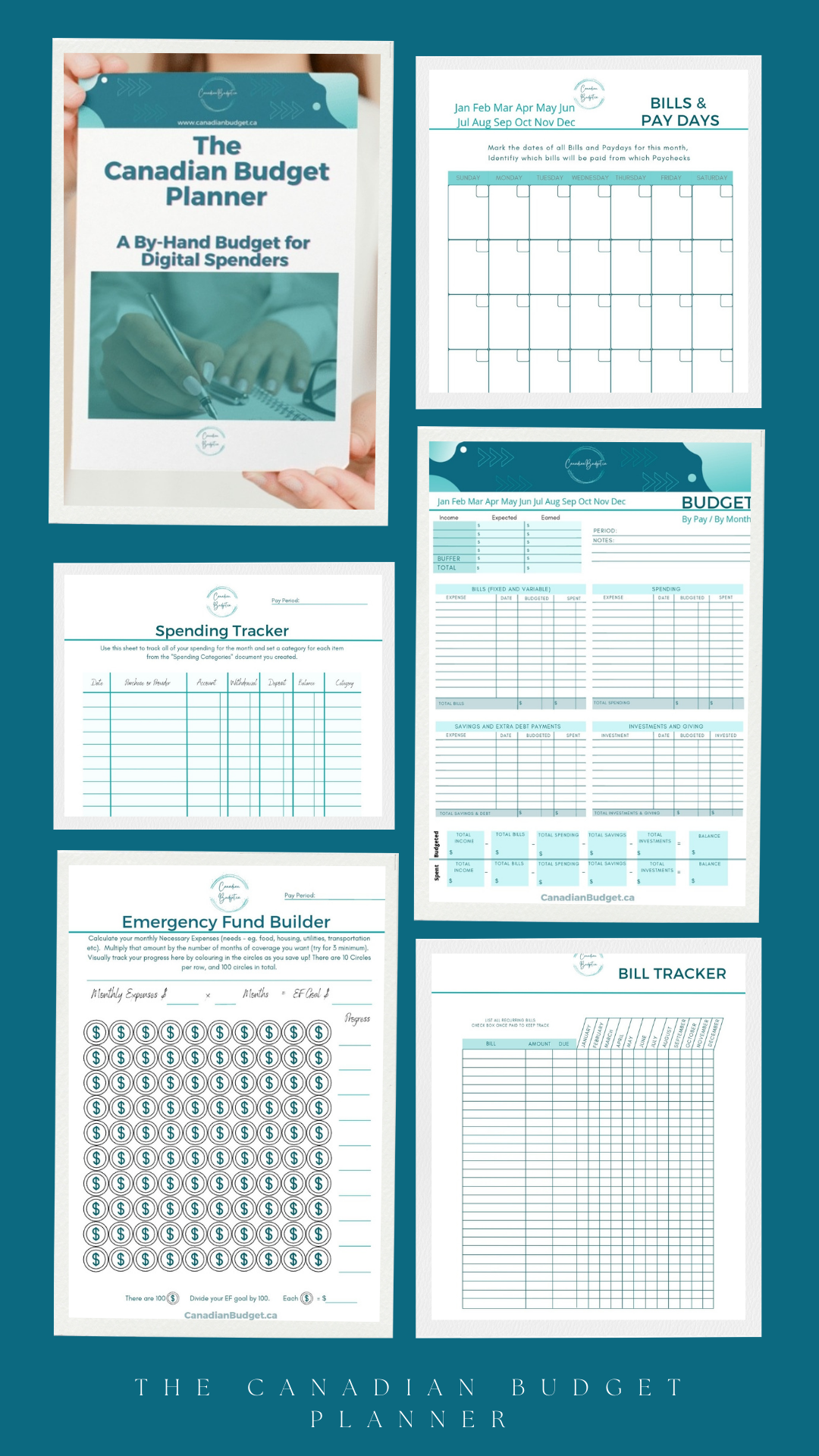

The Canadian Budget Planner is easy to use and customizable to your specific needs. It includes sections for tracking your expenses, setting spending and savings goals, and categorizing your expenses.

You’ll be able to see exactly where your money is going and make informed decisions about your spending. You’ll be able to track your progress and adjust your budget as needed to ensure that you’re staying on track.

But our budget planner isn’t just about tracking your spending. It also includes tips and strategies for managing your credit card debt, building your credit score, and achieving your financial goals.

With our printable budget planner, you’ll have everything you need to take control of your finances and achieve financial success. Plus, it’s printable, so you can use it anywhere, anytime, and as many times as you want!

The Canadian Budget Planner

is for you if....

is for you if....

Your spending gets away from you

You have a plan but often go over budget without realizing since you don't use cash.

You haven't been able to make significant progress on your debt or savings goals, despite having an idea of what you want to achieve.

You want to keep utilizing Credit Cards

You utilize cards because of the amazing benefits and points, but have a hard time knowing what you spent until the bill arrives at the end of the month.

You feel that budgeting apps aren't for you.

You spend a lot of time on your phone already, and want to get out of your phone.

The tactile pen and paper method helps you stay more organized.

So, how does it work?

Start with the planning documents

Get your finances in order by taking stock, setting goals, and making a plan!

Use the monthly budgets

Our Zero Based Budget will help you give your money a job!

Pay yourself first and put your money to work for you!

Review & Revise

At the end of each period, close out your budget and reflect. Revise as needed for the next period and start again!

How would you feel if you could:

Take control of your financial well being with the Canadian Budget Planner. It includes 14 separate documents which can help you organize your financial life once and for all!

-

Pay off your consumer debts - Build an Emergency Fund

- Plan your short and long term financial goals

- Build a budget that works

- Manage your spending better

- Spend how you want, without cash envelopes

- Keep your cards paid off so you never carry a balance

- Reflect on your monthly spending

- Keep bills and paydays organized in a calendar

- Track recurring bills so you never miss payments

-

Become confident managing your finances

THE CANADIAN BUDGET PLANNER

This is the last planner you ever need!

Why?

It's a printable PDF planner that is not dated.

You print out the budgets and spending trackers as needed.

Put it in a:

- Binder

- Clipboard

- Loose in a folder - You do you!

Print only the sections you need more of, instead of buying a new planner each year.

Frequently Asked Questions

Is this only for Canadians?

This is for everyone!

I am Canadian, my website is Canadianbudget.ca but this Budget planner is for Canadians AND anyone else! There is nothing excluding others from using this document.

Do you sell a hard copy?

I only sell the Canadian Budget Planner as a PDF.

Why?

I am not going to tell you how many copies of a spending tracker you need each month. You may also not want to carry around 100 pages at a time. With our PDF version, you can print what you need, as needed, as many times as you like.

Is this a monthly budget planner?

With the Canadian Budget Planner, you can budget any way you like. Use it to budget monthly, budget by pay period, or do both!

It’s up to you!

How much time does it take to use the planner?

To set up your planning documents and get yourself organized, I encourage you to take an hour or two to get all your information sorted. Some documents you will go back and update monthly or as needed.

To use the budget – it will take longer the first time you use it as you get used to it. Additional budgets should be quick to copy over what remains the same and review and revise what needs changing from last month.

Expense tracker – I recommend to track your spending as you go – Daily or weekly at most. The more frequent you do it, the less time overall it will take you. A few minutes a day, or 15 minutes a week should do it.

Monthly Review & Reflection – 15 minutes

How do I use the planner?

The Planner comes with detailed instructions on how to best use each of the documents included.

Update documents as needed as you work toward your goals.

Start with the Planning documents to get a clear picture of where you are today with your finances.

Make a plan for your money, Set your goals, ad get organized.

Create your first budget & start tracking your spending.

Refer back to your budget to compare your vision with what happened that month or pay period.

Get confident about your money with the printable Canadian Budget Planner made for digital spenders.

Toronto, Ontario, Canada

© Canadian Budget 2022