This post is sponsored by GreatCanadianRebates.ca.

In today’s digital-money world, credit cards are an indispensable tool. Almost no one is taught how to use a credit card before getting one, but, like any tool, using credit cards properly is critical. In this guide, we’ll answer the question, “How do you use credit cards wisely?” turning your money journey from survival mode to success.

How Do You Use Credit Cards? Here Are The Basics

Table of Contents

ToggleHow do you use credit cards? It’s not something we are taught in school. You likely signed up for your first credit card before considering this question.

Let’s keep it simple. A credit card isn’t just plastic or free money; it’s a way to borrow money from a lender up to a limit. It’s not like a debit card that takes money straight from your account. You borrow money from your credit card company, agreeing to pay it back by your due date, or you will be charged interest on the card balance.

It’s essential to understand the terms of your Credit Card Agreement. You need to understand your credit limit and APR. Annual Percentage Rate (APR) is the cost of borrowing money on your credit card. The average credit card APR or interest rate is usually between 19%-25.99%.

Credit card companies make a lot of money because most people don’t know how to use credit cards properly, carry a monthly balance, and pay them a lot of interest.

Let’s cover some of the basics you need to know to use credit cards properly:

- Credit is not free money – you need to pay it back within a set period, or you are charged interest

- Understand your billing cycle and payment due dates

- There is usually a 30-day grace period before interest is charged – check your cardholder agreement for details

- Understand how much you would be charged if you don’t pay the bill on time (divide APR by 12 – then multiply that by your outstanding balance)

- Rather than focus on the Minimum Monthly Payment, commit yourself to always paying the bill in full.

- Avoid taking cash advances on your card. They cost you more in interest and typically aren’t eligible for the grace period, so advances start accruing interest immediately.

- How you use credit cards will affect your credit score and can affect your financial life for years to come.

Making Credit Cards Work for You

So, how do you use credit cards to your advantage? Get the good stuff by using credit cards the right way. Here are the top tips on getting good with credit cards:

- Understand your budget and income well before spending on a credit card.

- Only spend what you can afford to pay off right away.

- A credit card is not an emergency fund – Prioritize building an emergency fund in a high-interest savings account.

- Don’t save your credit card details on websites – putting one step between you and a purchase can help keep spending in control.

- Don’t make your credit card bill an afterthought; never miss a payment.

- Avoid carrying a balance and building up more debt than you can repay.

- Track your credit card spending to be more aware of your spending habits – it can easily slip away from you.

- Commit to yourself to pay your bill in full each month.

- Turn on credit card alerts to stay in the loop and catch fraudulent activity quickly.

- Using credit responsibly can help you build up a good credit history that will benefit you in the future.

Steering Clear of Trouble

Credit cards can be amazing, but watch out for common pitfalls. How do you use credit cards without getting into trouble? It’s important not to go wild with your spending or carry significant balances. Canadians carried over $113.4 Billion in Credit card debt at the end of 2023. The goal of this article is to make sure you are not part of that statistic.

Maxing out your card is never a good idea – just because you have a credit limit doesn’t mean you should spend it all. If you keep your spending low and continue to pay off the balance in full regularly, this can really help you!

Always pay your bill on time and keep an eye on your spending. To ensure you aren’t raking up lots of debt, a good practice is paying off your purchase as soon as you make it. You do not have to wait until you receive your bill to pay off your credit card.

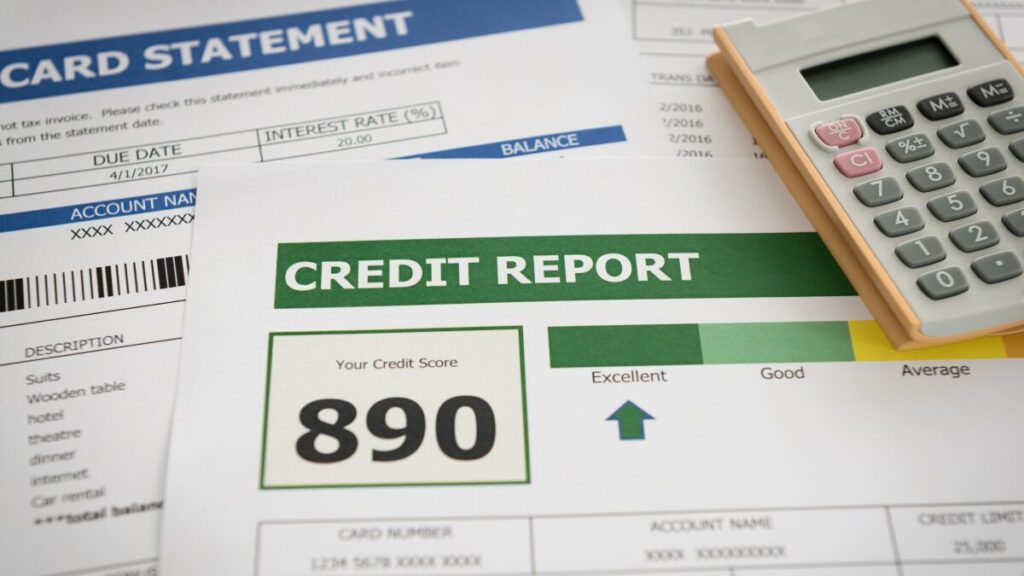

How do you use credit cards to build your credit score?

How do you use credit cards to build credit? By using them responsibly. Your credit score is like a money report card. What are some good habits to ensure your credit score in Canada stays strong? Pay your bills on time, keep your credit balances low, don’t max out your card, and don’t apply for too many cards simultaneously. Applying for new lines of credit results in a hard credit check that reduces your credit score temporarily. Check your credit report regularly to keep it in shape.

Tips for Handling Credit Card Debt

How do you use credit cards wisely if you’re in debt? If you find yourself in debt, don’t panic. Make a plan by stopping spending on your cards and ensuring you continue to pay the minimums on all card balances each month. Then, work on a budget to help you create a plan to pay off your debt.

Getting the Goodies: Credit Card Rewards

How do you use credit cards for rewards? Credit cards can give you cool rewards – like cashback or travel perks. When choosing which credit card to open, the perks may be a strong consideration for you. These credit card rewards can be amazing, but they’re only worth it if it is not costing you money. That means prioritizing paying off your monthly balance to reap the full rewards.

Conclusion: Mastering Credit Cards

How do you use credit cards like a champ? By following the tips outlined in this article! Credit cards can be excellent tools to help you be a money pro – if used wisely! Whether you’re just starting or want to level up your credit habits, this guide gives you the scoop on how to use credit cards wisely and rock your money game.

More from the blog...

Guest Post by Karan Sachdeva of MultiTaxServices Doing taxes in Canada Money management often feels like one of those “I’ll...

Read More

How to Do a Financial Reset for the New YearAs the new year begins, it's the perfect time to take...

Read More

Starting your journey towards Financial Independence Retire Early (FI/RE) in Canada opens up possibilities for those eager to take control...

Read More

Public sector roles, including those in schools and hospitals, make up approximately 21% of employment in Canada. That includes teachers...

Read More

If you are new to investing, you might be wondering what the Canadian investment accounts are available, and which is...

Read More

Canadian Real Estate Investment Trusts: What They Are and Should You Invest? Canadians have heard owning property was the path...

Read More

Struggling with debt can significantly impact your financial well-being, especially if your credit score suffers. Fixing credit scores is important...

Read More

When is a good time to calculate retirement savings needs? When retirement may be decades away it’s hard to think...

Read MoreAbout The Author

Jessica Morgan

Jessica Morgan is the founder and CEO of Canadianbudget.ca. She is passionate about personal finance and helping Canadians improve their financial literacy by providing more Canadian focused financial content. A millennial mom of one, she has a burning obsession with all things personal finance.

Jessica has a BA in East Asian Studies from York University and a Masters in Business Administration from Toronto Metropolitan University. She is a career public sector employee with a Hybrid Pension, and an advocate for Canadian women to improve their personal finance knowledge.

Jessica Morgan

Jessica Morgan is the founder and CEO of Canadianbudget.ca. She is passionate about personal finance and helping Canadians improve their financial literacy by providing more Canadian focused financial content. A millennial mom of one, she has a burning obsession with all things personal finance.

Jessica has a BA in East Asian Studies from York University and a Masters in Business Administration from Toronto Metropolitan University. She is a career public sector employee with a Hybrid Pension, and an advocate for Canadian women to improve their personal finance knowledge.