Is The 50 30 20 Budget Method Right For You?

Table of Contents

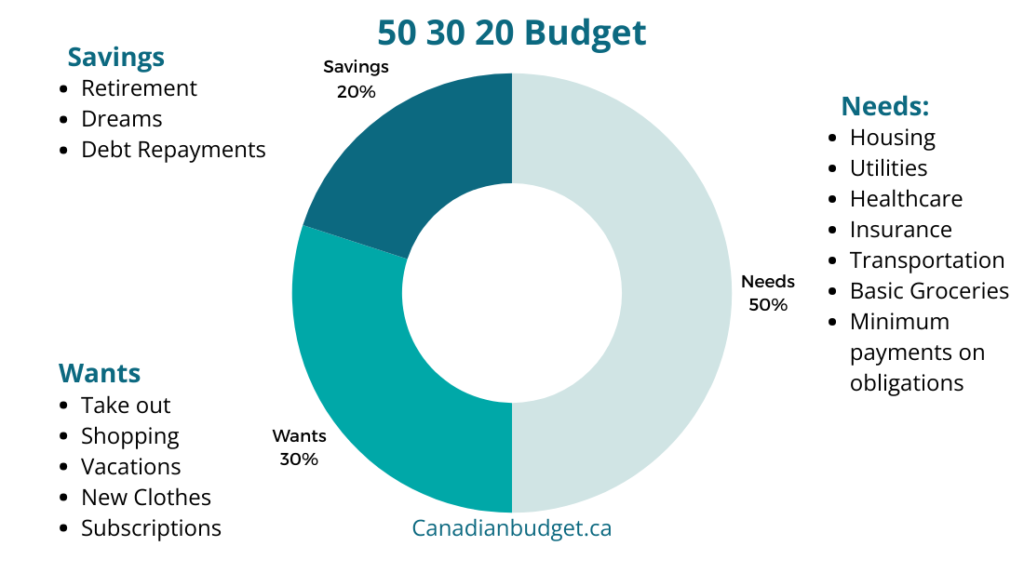

ToggleIs the 50 30 20 Budget Method Right for You? Find out now! This budgeting method, popularized by the book All Your Worth, divides your income into three categories: 50% for essentials, 30% for wants, and 20% for savings and debt repayment. It’s a friendly and effective way to manage your finances and achieve your financial goals.

50-30-20 claims to be a one-size-fits-all budgeting technique that can help you no matter your financial situation. In this article, we will cover everything you need to know about the 50 30 20 budget so you can determine if it is right for you!

Where did the 50 30 20 budget rule originate from?

Overview Of The Book: All Your Worth

Even though I was familiar with this budgeting method, I decided to read the book to understand the complete picture and what the originators of this budget feel should be included or excluded from the categories.

This book’s target audience needs help to get a handle on their money and save for tomorrow. Although their references seem very old-fashioned (it was written in 2006 – which I can’t believe was almost 20 years ago), the ideas still apply today. Let’s break down what it’s all about.

6-Step Approach to Money Management

All Your Worth discusses its six-step approach to managing money for life, which includes the 50/30/20 budget framework at its core.

Step 1: Count All Your Worth

You must know your starting point, where you are, and your income, bills, and expenses. Knowing this is necessary to improve your financial situation. At this point, you should be figuring out what constitutes a need, want, and savings.

Interestingly, they advise adding employer retirement contributions and life insurance deductions to your overall income. They say both build towards lifetime savings, so they should be included.

Step 2: Escape From The Thinking Traps

Warren and Tyagi Warren discuss a lot of money mindset in this section, including overcoming the mental stumbling blocks that hold us back from financial success. They focus on five money stumbling blocks:

- All or nothing

- Money is too hard

- Finger pointing

- Waiting for the money bunny

- Counting the pennies

Step 3: Count The Dollars, Not The Pennies

Find ways to focus on the big picture items instead of pinching every penny. Do you have too much insurance? Can you refinance your mortgage or cut on non-essential subscriptions? Look at where you can save on the big items first.

Depending on their situations, some people may need to make deep cuts in their lifestyles, such as looking for a higher-paying job, selling a car, or moving.

Step 4: If You Can’t Afford Fun, You Can’t Afford Your Life.

If your must-haves consume all your income, you have nothing to save and enjoy. You have nothing to save and enjoy if your must-haves consume your income. If you can’t enjoy your life, consider what changes need to be made to increase your income or decrease your major expenses.

Step 5: To Build Your Future, Pay Off Your Past

They focus on doing everything you can to get out of debt. They are hardcore here, recommending liquidating everything you have except keeping a $1000 Savings Fund to attack your debt and get rid of it as soon as possible. They refer to consumer debt as “Steal From Tomorrow” debts because you are robbing yourself of a solid financial future.

Step 6: Build Your Dreams Little By Little ( A 4-Stage Plan)

How do the authors recommend you implement all of this in priority order?

Stage 1: Save $1000

Stage 2: Pay off “Steal From Tomorrow” Debts

Stage 3: Build a 6-Month Security Fund in a High-Interest Savings Account

- Security fund is equal to your Must Haves x 6

Stage 4: Lifetime of wealth creation

- Save for retirement (10%) If an employer contributes to a pension, put in less.

- Pay off your house (max 5% of income)

- Save for other dreams (5%)

- Invest in the stock market for goals over 5 years – in an Index Fund focusing on the S&P 500.

Introduction to the 50 30 20 budget method

Now that we have more background on this budget and financial framework, how do we apply it? It’s easy to think about the division of the budget, but what goes where in the mind of the creators of this budget?

Use 50% Of Your Budget To Cover Your Needs & Essentials

This category is what the authors term “Must Haves,” aka your needs and essentials, such as a roof over your head, utility bills, basic groceries to sustain you, and long-term legal obligations and contracts that require payment.

Spend 30% of Your Budget On Your Wants

The money available for your wants is what is left over after your Needs and Savings are allocated. Because of this, you may hear it referred to as 50-20-30 instead of 50-30-20 since savings should come first.

One of the things I love about the book is that the authors advocate for Loud Budgeting (Yep, they were doing this back in 2006).

The authors want everyone to have some money to spend on themselves, no questions asked.

20% of your budget goes to Savings & Debt

With this 20%, the focus should be on getting yourself out of debt as quickly as possible. Once the debt is under control and out of the way, 20% can go to your savings and retirement goals.

They encourage 10% for retirement (or less if you have an employer contribution to your pension), a maximum of 5% on mortgage prepayments (on top of your regular payments IF this is your priority), and 5% saved for your dreams.

They do encourage investing for any goals beyond 5 years. If you are still determining if investing is right for you, here are 5 reasons you should be investing, and here is where you can start if you are a beginner investor.

How to Start Using The 50 30 20 Budget

Track Your Expenses

Sticking to a percentage-based budgeting method is only possible if you know how much you spend. Tracking your expenses is a game changer for anyone improving their budgeting. Knowing how much and what you spend is the first step to utilizing a 50-30-20 budget.

Understand Your Income

Another critical step is understanding how you earn income and when those amounts hit your bank account. How frequently are you paid? Do you receive any government benefits? Are there any other income sources that you have or could start receiving? Does your income cover all your expenses today, or are you in the red each month?

Identify Your Must-Haves

What a lot of people think are Must-Haves or needs are actually wants. They are pretty bare-bones about what qualifies as a Must-Have.

Automate Your Savings

Put that 20% into your savings and debt repayment goals no matter what; it should come before your Wants, and you want to ensure you are not short-changing your future self by skimping on savings.

Stay consistent

The authors propose that the 50/30/20 budget is a lifetime plan. It’s not a quick-fix money diet but a long-term healthy living plan!

Pros of the 50 30 20 Budgeting Style

- Simple

- Worry-free

- Easy to automate

- Helps you build wealth

Cons of the 50 30 20 budget

- Doesn’t account for external factors like the High Cost of Living areas, which may push Needs above 50%

- Too rigid

- Doesn’t account for prioritizing values-based spending

- Recommends focusing on using cash only

Is the 50/30/20 Budget Method Still Relevant?

50 30 20 Budget Calculator

I wanted to see how closely my budget aligned with the 50/30/20 budget framework, so I created a spreadsheet to help me check. Download our FREE 50 30 20 Budget Calculator Spreadsheet to compare where your budget falls in the 50/30/20 budget framework.

Alternatives to the 50/30/20 Budget

- Cash Envelope Budget

- 80/20 Budget

- Zero Based Budgeting

- Values Based Budgeting

The Bottom Line

Although I don’t love the authors’ focus on a cash-only budget – it’s just not realizing in 2024 and post-pandemic. Some of their objections from 2024 were pre-technology advances that made seeing your credit balance instant and offered easier ways to monitor your credit spending. However, I still think the budget has some merits in giving guidelines for a starting point.

The proper budget helps you reach your financial goals using your preferred method. Whether or not 50/30/20 is still relevant or will work for you, it will be good to check out where your current budget lands compared to this framework. Download our Free 50/30/20 Budget comparison spreadsheet to see how your budget stacks up.

About The Author

Jessica Morgan

Jessica Morgan is the founder and CEO of Canadianbudget.ca. She is passionate about personal finance and helping Canadians improve their financial literacy by providing more Canadian focused financial content. A millennial mom of one, she has a burning obsession with all things personal finance.

Jessica has a BA in East Asian Studies from York University and a Masters in Business Administration from Toronto Metropolitan University. She is a career public sector employee with a Hybrid Pension, and an advocate for Canadian women to improve their personal finance knowledge.