What A Budget Is... And Is Not!

Guest Post by Ohh You Budget

I love having guest writers come in and share their thoughts on what budgeting means to them, and their own unique style. I am very excited to welcome my friend Deidre for this guest post on ‘What a Budget Is and Is Not’ to her.

Deidre the face behind Ohh You Budget.

Deidre has always been the go-to person for personal finance advice among her friends and family..

But it wasn’t always that way.

She graduated with a degree in business marketing and collected every debt along the way. Deidre made it her mission to educate herself out of debt into wealth, sharing her knowledge, experience, and her love for budgeting along the way. She wholeheartedly believes that the path to wealth and financial freedom starts at ground zero, and that’s with a budget.

What a budget is and is not

When you think of the word budget, what comes to mind?

Now, if you are someone who budgets successfully, you may have a list of words that are completely different from someone who doesn’t budget or has consistently fallen off their budget.

However, for the majority of people, the word budget is associated with the following words or phrases:

- Restrictive

- Control

- Limit

- Frugality

- Cutbacks

- Hard to do or understand

- Something you do when you make enough money

- Something poor people do

And the list goes on.

Simply put, budgeting is the act of telling your money what to do and where to go.

A more elaborate way of putting it is budgeting is the process of creating a plan to manage your income and expenses over a certain period of time, usually on a month-to-month basis. It involves setting financial goals, estimating your income, identifying and tracking your expenses, and making adjustments as needed, so you know what your money is doing.

What a budget is

A budget is:

- Having a plan for your money each month

- Putting a monetary amount towards your needs and wants (if you like Starbucks and can afford to enjoy it, put it in the budget)

- A way to spend freely within YOUR set guidelines

- Meant to be adjusted and tweaked (I encourage a fresh set of budgeted expense numbers for every month, i.e., just because you budgeted $400 on groceries last month doesn’t mean you have to budget $400 this month)

- Meant to help you reach your bigger financial goals

- Flexible and adaptable

Now that we know what budgeting is, let me tell you what budgeting is not, because I am guilty of once thinking this too.

What a budget is not

A budget is not:

- A ‘spend as little as I can’ plan

- Restrictive (if you feel it is, it’s because you are making it that way)

- For people who are poor

- A one size fits all (if one method isn’t working for you, try another method)

- Hard or difficult to grasp

- A one-time event

- Fixed/set in stone (it can be changed as many times as you would like)

- Just tracking your expenses (did you know you can still do a budget and not track every purchase you make?)

Overall, the purpose of budgeting is to help you make informed decisions about your finances, ensure that you have enough money to cover your necessary expenses, and make progress toward your long-term financial goals, like getting out of debt. A well-designed budget can also help you avoid overspending and reduce financial stress.,

So, now that we have reframed what budgeting is and is not, let’s put it into practice!

Follow @ohhyoubudget on Instagram and TikTok for more budgeting tips, and check out her Etsy shop for great budgeting tools.

Big thanks to Deidre for sharing her unique approach to budgeting!

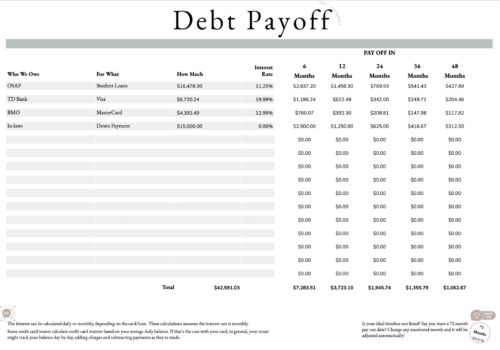

She has graciously shared with Canadian Budget readers, a

FREE DEBT PAYOFF SPREADSHEET

to help you kick-start your budgeting, so be sure to download it today!

More from the blog...

Do You Need an Accountant…

Guest Post by Karan Sachdeva of MultiTaxServices Doing taxes in Canada Money management often feels like one of those “I’ll...

Read More

Why Wealthsimple Could Be the…

Wealthsimple Banking Review 2025: Best No-Fee Bank in Canada

Read More

Financial Reset For The New…

How to Do a Financial Reset for the New YearAs the new year begins, it's the perfect time to take...

Read More

The 5 Types of Financial…

Starting your journey towards Financial Independence Retire Early (FI/RE) in Canada opens up possibilities for those eager to take control...

Read More

In a Public Sector role?…

Public sector roles, including those in schools and hospitals, make up approximately 21% of employment in Canada. That includes teachers...

Read More

8 Canadian Investment Accounts To…

If you are new to investing, you might be wondering what the Canadian investment accounts are available, and which is...

Read More

What Are Canadian Real Estate…

Canadian Real Estate Investment Trusts: What They Are and Should You Invest? Canadians have heard owning property was the path...

Read More

6 Ways Fixing Credit Scores…

Struggling with debt can significantly impact your financial well-being, especially if your credit score suffers. Fixing credit scores is important...

Read More

The Paying Yourself First Method

Taking control of your financial future starts with a simple yet powerful concept: paying yourself first. Shifting your money mindset...

Read More

How to Calculate Retirement Savings…

When is a good time to calculate retirement savings needs? When retirement may be decades away it’s hard to think...

Read MoreAbout The Author

Deidre Cross - Ohh You Budget

Deidre, the face behind Ohh You Budget, has always been that go-to friend for personal finance advice. But it wasn’t always that way. She graduated with a degree in business marketing and collected every debt along the way, Deidre made it her mission to educate herself out of debt into wealth sharing her knowledge, experience, and her love for budgeting. Deidre wholeheartedly believes that the path to financial wealth and financial freedom starts are ground zero, and that’s with a budget.

Deidre Cross - Ohh You Budget

Deidre, the face behind Ohh You Budget, has always been that go-to friend for personal finance advice. But it wasn’t always that way. She graduated with a degree in business marketing and collected every debt along the way, Deidre made it her mission to educate herself out of debt into wealth sharing her knowledge, experience, and her love for budgeting. Deidre wholeheartedly believes that the path to financial wealth and financial freedom starts are ground zero, and that’s with a budget.