This post is sponsored by GreatCanadianRebates.ca

As someone who has visited 38 countries and frequented many hotels worldwide, I want to discuss why hotels.com Canada offers the best loyalty program.

Frequent travellers often have differing views on the best hotel points rewards program. Some travellers are loyal to one hotel brand and their loyalty program. I’ll tell you why I decided to stick with hotels.com as my main hotel loyalty program and how using the best travel credit cards can make your stays through Hotels.com Canada more rewarding.

Hotels.com Canada Review

Table of Contents

ToggleHotels.com is one of the most well-known online travel agents specializing in hotel bookings. The Expedia group owns it and several other top travel brands. They provide access to top brand name hotel listings and Air B&B style private stays.

User-Friendly Interface

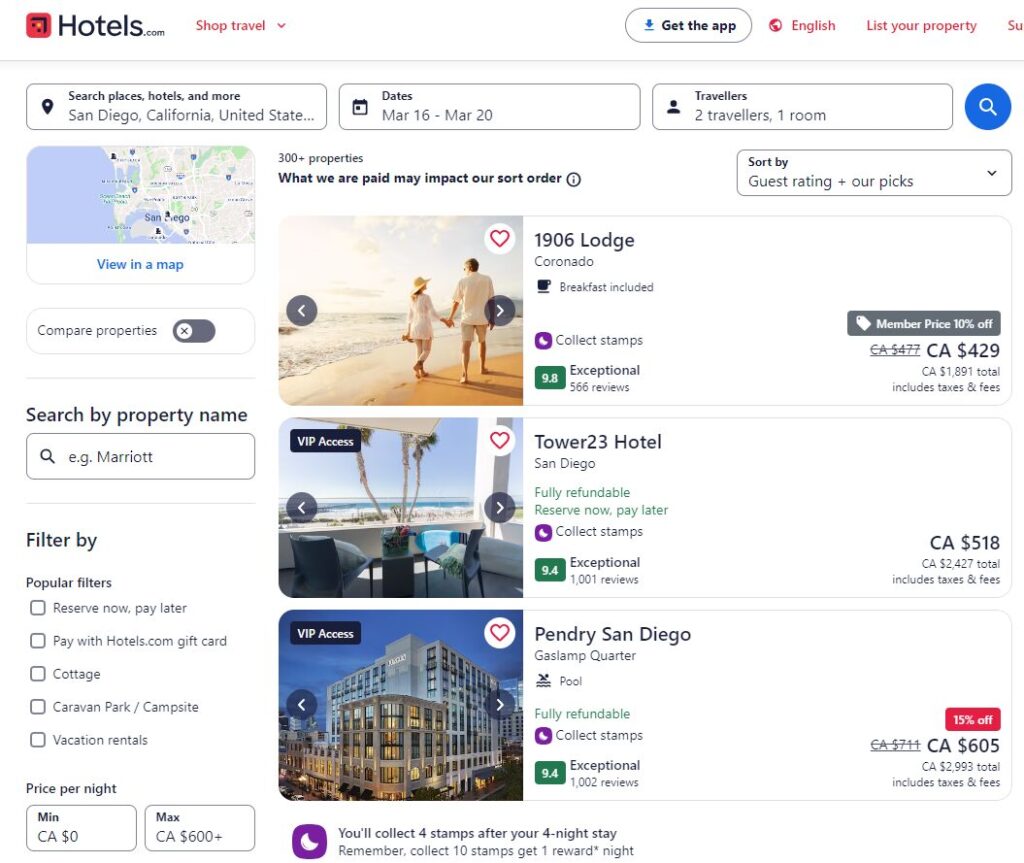

The Hotels.com Canada website and app are straightforward to navigate. They allow searching and filtering by multiple characteristics, searching on a map or list view, and favoriting listings for later review.

Extensive Hotel Options

They provide access to top brand-name hotel listings and Air B&B-style private stays. You can choose between 5-star hotels, budget-friendly options, and everything in between. If you are a loyal hotel-brand rewards program member, it’s easy to filter by the brand names you may be searching for. So, you definitely won’t miss out on any property.

Flexible Rewards Program

The Hotels.com Rewards program lets you earn “stamps” for each night you stay at an eligible hotel. After gaining ten stamps, you get one free night with the average value of the ten stamps you collected.

Being a member of their rewards program also entitles members to discounts on bookings through special Member Pricing. The program offers three tiers of membership, each providing more benefits the more nights you stay.

Tier 1: Hotels.com Rewards

This tier is for members who have earned 0 – 9 stamps. It grants access to member pricing.

Tier 2: Hotels.com Rewards Silver

Members who have earned 10-29 stamps get benefits like complimentary breakfast and Wi-Fi, a price guarantee which will refund the difference if you find a better price and priority customer service.

Tier 3: Hotels.com Rewards Gold

For members who have earned more than 30 stamps, Gold Members receive free room upgrades, early check-in and late check-out, and a free upgrade to Avis Preferred Plus membership for car rentals.

Why I Prefer Hotels.com over Hotel Chain Branded Loyalty Programs

-

- The flexibility of choosing any property based on your travel budget, preferences, location, and many other attributes.

-

- There are many options for fully refundable bookings with no upfront reservation fee. If your plans change, you won’t be penalized for cancelling.

-

- You can use any hotel chain regardless of destination and still get rewards.

-

- Earn free nights at almost any hotel – 1 night free after ten stays at eligible properties.

-

- If you are also a member of the chain reward program, you can earn the brand’s points on additional purchases during your stay while still partaking in their programs.

I used to travel a lot for work, and at one point, I reached Hotels.com Rewards Gold Status. I have personally redeemed 15 free hotel nights through Hotels.com Canada!

Hotels.com Canada Additional Bonus:

If you are looking for a Hotels.com coupon code in Canada, Great Canadian Rebates offers a 4% Cash Back Rebate on Hotels.com Canada bookings.

The Best Travel Credit Card Combos for Added Value

For frequent travellers, a travel credit card is one of the best tools in our toolbox! It can provide Lounge access, multiply your earning points on travel, provide hotel privileges, rental car insurance, trip cancellation and delay coverage, and so much more. When using credit cards for points, it is essential to use credit cards wisely, pay the balance in full every month, and not carry credit card debt.

Multiply your benefits when you use a travel credit card when using Hotels.com and paying for your travel-related purchases. We will review cards that offer varying loyalty programs: Aeroplan, Amex Member Rewards, TD Rewards, and Scene Plus Rewards. Let’s check out four of the best travel credit cards in Canada to see what benefits and bonuses they offer.

A Few Of The Best Travel Credit Cards In Canada

American Express Cobalt Card

The Amex Cobalt Card is a great entry point for cards that charge annual fees. The Annual fee is broken up into monthly charges of $12.99, which makes it easier for most people to fit it into their budget. One of the best features is the flexibility of the American Express Member Reward points.

MR Points are incredibly flexible. They can be used for travel, merchandise, and statement credits and transfer to many other loyalty programs, such as Aeroplan (1:1), Delta Sky Miles, Hilton Honors, Marriot Bonvoy, Ethiad, and more.

Fees & Interest

Monthly Fee: $12.99 ($158.88 Annually)

Interest Rates:

20.99% on Purchases

21.99% on Cash Advances

Sign-Up Bonus & Current Offer

The Amex Cobalt sign up bonus can earn you up to 15,000 Membership Rewards Points in the first year.

Earn 1,250 MR Points when you spend at least $750 in a billing cycle.

Earning Points

Cardholders earn American Express Member Rewards (MR Points).

Earn 5x Points on eligible food and drink, 3x points on eligible streaming services, 2x points on ride shares, transit and gas. Cardholders can earn 1 additional point on eligible hotel and car rental bookings made through the American Express Travel Online.

American Express Cobalt Card Additional Bonus:

Sign up for your card through Great Canadian Rebates and receive a $100 Cash Back Rebate in addition to your sign-up bonuses!

American Express Aeroplan Card

The Amex Aeroplan Card differs from the others on our list because it is a Charge Card. Charge Cards are expected to be paid in full monthly. Otherwise, you are subject to very high interest charges. Before getting a charge card, consider whether you can pay your bill in full every month. If you are also a frequent Air Canada flyer, consider the American Express Aeroplan Card.

Do you spend more than $1000 on your credit card each month? Some of the sign-up bonuses require a minimum spend. They also provide bonuses after the first year to entice cardholders to maintain card membership.

Fees &

Interest

$120 Annual Fee

Charge Card: No Preset Limit – Must pay your card in Full!

Interest Rate: A 30% annual interest rate applies to balances not paid in full.

Sign-Up Bonus & Current Offer

Earn up to 40k Aeroplan Points across your first 14-17 months of card membership:

3k Points each month you spend $1000 for the first 10 months

10k points for a purchase between 14 – 17 months of membership

Earning

Points

Cardholders earn Aeroplan Points. Aeroplan Points do not convert into other programs. However, you can convert your points from the following programs into Aeroplan points:

Marriott Bonvoy, Hilton Honors, All-Accor Live Limitless, Best Western Rewards, Choice Privileges, Coast Rewards, IHG One Rewards, Shangrila, Golden Circle Award, Wyndham Rewards

American Express Aeroplan Card Additional Bonus:

Sign up for your card through Great Canadian Rebates and receive a $75 Cash Back Rebate on top of your sign-up bonuses!

TD First Class Travel Infinite Visa Card

The TD First Class Travel Infinite Visa Card has an annual fee and requires a $60,000 personal or $100,000 household annual income to be eligible. The card earns TD Rewards Points, which are not transferable to airline miles or other points programs.

TD has a portal for cardholders to book travel called Expedia for TD. Users can log in and purchase travel or redeem points for travel through this portal. Although you earn more points for travel purchased through that portal, you can also earn and redeem points for travel booked outside of that portal, so you are not stuck using only Expedia for TD.

Fees &

Interest

$139 annual fee

Interest Rate:

20.99%

Cash Advance Interest Rate:

22.99%

Sign-Up Bonus & Current Offer

Up to $800 in Value, including 100k TD Rewards Points.

First Year Fee Waived

20K Points on your first purchase

80k Points for $5000 spent in the first 180 days

Birthday Bonus ok 10K Points.

Earning

Points

Cardholders earn TD Rewards Points. You cannot transfer TD Rewards points to outside loyalty programs. However, you can use them for various purposes, including travel, merchandise, rental cars, and statement credits for any purchase.

* 8 points per $1 spent on travel booked online through Expedia For TD

* 6 points per $1 spent on groceries and restaurants

* 4 points per $1 spent on recurring bill payments

* 2 points per $1 spent on all other purchases

TD First Class Travel Infinite Visa Card Additional Bonus:

Sign up for your card through Great Canadian Rebates and receive a $100 Cash Back Rebate in addition to your sign-up bonuses!

Scotiabank Passport Infinite Visa Card

The Scotiabank Passport Infinite Visa Card has an income requirement to apply: $60,000 personal or $100,000 per household (or a minimum assets under management of $250,000). This card earns Scene + Points, which can be redeemed for various things or applied as a credit to your card balance.

Scotiabank Passport Infinite Visa cardholders can access Scene+ Travel (another member portal like the Expedia for TD portal). Members can also book travel wherever they like (through a travel agency or online) and redeem Scene+ points for their purchases.

Fees &

Interest

$150 annual fee

Interest Rate:

20.99%

Cash Advance Interest Rate:

22.99%

Sign-Up Bonus & Current Offer

Up to $1300 in Value, including up to 40k Scene+ Points.

First Year Fee Waived

Earn 30k points by spending $1000 in the first three months

10k annual points bonus when you spend $40,000 annually

Earning

Points

Scotiabank Passport Infinite Visa card members earn Scene+ Points.

3X the points on eligible grocery, dining and entertainment purchases

2x the points on other grocery, dining and entertainment purchases

2x the points on daily transit options

Scotiabank Passport Infinite Visa Card Additional Bonus:

Sign up for your card through Great Canadian Rebates and receive a $60 Cash Back Rebate on top of your sign-up bonuses!

Comparing The Benefits Of The Best Travel Credit Cards

When comparing different travel cards, many benefits are to be considered. Preferences on points usage are among the top. Do you always fly Air Canada? An Aeroplan Credit Card or American Express Card that earns MR points may work best for you. Consider the card’s benefits, including insurance coverage, lounge access, sign-on bonuses, and travel preferences, to pick the best card for yourself.Using Hotels.com Canada with your Travel Credit Cards

Using the best travel credit cards when you book your travel on Hotels.com Canada is a no-brainer. You can get sign-up bonuses and rewards by opening a new travel credit card and earn additional cashback through a site like Great Canadian Rebates again when you are ready to book your travel through Hotels.com Canada. Stacking sign-up bonuses, cash-back rebates, rewards programs and earning free nights is a winning travel combination! Make sure to explore these options for a seamless and rewarding travel experience.Disclaimer: All credit card offers are subject to change; check with the offering card websites for the most up-to-date information.

More From The Blog...

Do You Need an Accountant…

Guest Post by Karan Sachdeva of MultiTaxServices Doing taxes in Canada Money management often feels like one of those “I’ll...

Read More

Why Wealthsimple Could Be the…

Wealthsimple Banking Review 2025: Best No-Fee Bank in Canada

Read More

Financial Reset For The New…

How to Do a Financial Reset for the New YearAs the new year begins, it's the perfect time to take...

Read More

The 5 Types of Financial…

Starting your journey towards Financial Independence Retire Early (FI/RE) in Canada opens up possibilities for those eager to take control...

Read More

In a Public Sector role?…

Public sector roles, including those in schools and hospitals, make up approximately 21% of employment in Canada. That includes teachers...

Read More

8 Canadian Investment Accounts To…

If you are new to investing, you might be wondering what the Canadian investment accounts are available, and which is...

Read More

What Are Canadian Real Estate…

Canadian Real Estate Investment Trusts: What They Are and Should You Invest? Canadians have heard owning property was the path...

Read More

6 Ways Fixing Credit Scores…

Struggling with debt can significantly impact your financial well-being, especially if your credit score suffers. Fixing credit scores is important...

Read More

The Paying Yourself First Method

Taking control of your financial future starts with a simple yet powerful concept: paying yourself first. Shifting your money mindset...

Read More

How to Calculate Retirement Savings…

When is a good time to calculate retirement savings needs? When retirement may be decades away it’s hard to think...

Read MoreAbout The Author

Jessica Morgan

Jessica Morgan is the founder and CEO of Canadianbudget.ca. She is passionate about personal finance and helping Canadians improve their financial literacy by providing more Canadian focused financial content. A millennial mom of one, she has a burning obsession with all things personal finance.

Jessica has a BA in East Asian Studies from York University and a Masters in Business Administration from Toronto Metropolitan University. She is a career public sector employee with a Hybrid Pension, and an advocate for Canadian women to improve their personal finance knowledge.

Jessica Morgan

Jessica Morgan is the founder and CEO of Canadianbudget.ca. She is passionate about personal finance and helping Canadians improve their financial literacy by providing more Canadian focused financial content. A millennial mom of one, she has a burning obsession with all things personal finance.

Jessica has a BA in East Asian Studies from York University and a Masters in Business Administration from Toronto Metropolitan University. She is a career public sector employee with a Hybrid Pension, and an advocate for Canadian women to improve their personal finance knowledge.