The most widely touted advice among financial influencers on the internet is to “just invest in the S&P 500.” But what exactly is the S&P 500 Index, and how do you buy it?

To answer these questions, I need to take you back to basics. If you are new to investing, this will be a good primer for you; for those already investing, you may be getting a refresher here, but I hope you’ll bear with me. You might learn something new. So, let’s dive into it!

What is an Index?

Table of Contents

ToggleAn index is a grouping of different securities that can be used as a standard, measurement, or benchmark to track specific market segments. Indexes or Indices are indicators of the health of the current financial environment, which is why you often see them reported about and in the news. Each index has a set of rules to govern what is included within them.

Some indexes you may be familiar with are:

- The S & P 500

- The Dow Jones Industrial Average

- Nasdaq 100

- S&P/TSX Composite

- S&P/TSX 60

- Wilshire 5000

- FTSE 100

- MSCI ACWI

- MSCI EAFE

- MSCI World

- And more.

An index can focus on a country, industry, or trend. You’ll want to look at the index provider and whether they are reputable, as well as the methodology, selection criteria, etc. Understand the rules regarding what is included in the index.

Who are Standard and Poor, and why should you care?

Standard and Poor, or S&P Global, is a credit rating agency and index provider. It researches, evaluates, and grades credit risk or creditworthiness. They are responsible for the S&P 500 Index.

What Is The Standard And Poor’s 500 Index?

The S&P 500 index includes the top 503 – 505 large-cap companies in the US listed on the New York and Nasdaq Stock Exchanges. You can review the full list of S&P 500-included companies. It has become so ubiquitous that when people refer to “the market,” they usually mean the S&P 500 Index.

What Is An Index ETF?

An index ETF tracks a specific index (such as the S&P 500 or others) and holds all the stocks within that index under one fund. It allows investors to purchase parts of all those companies by executing a single trade. Instead of buying 500 companies within your portfolio with individual trades, an index ETF comprises parts of all the companies within the index, so you can make one purchase and own them all.

When discussing an Index Fund, this usually means an Index Mutual Fund. With this kind of fund, trades are made once a day. An S&P 500 Index ETF is a fund that tracks an index and can trade whenever the market is open.

An Index ETF often makes investing much more affordable because the price of an ETF compared to the cost of an individual stock can sometimes be much less, allowing more people to become shareholders at lower price points.

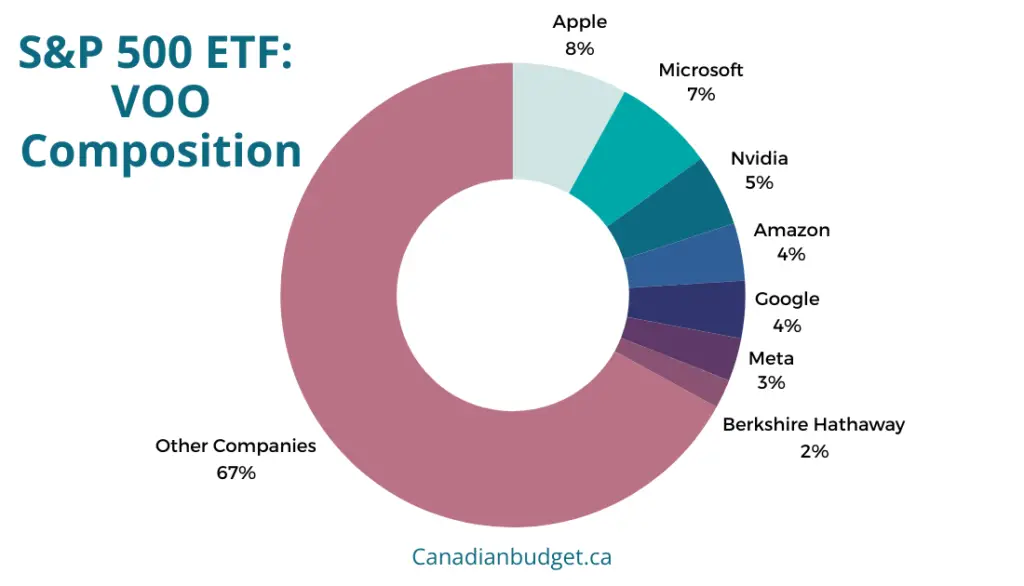

Below is a rough composition of one of the most well-known S&P 500 ETFs (VOO) by its top holdings.

Why people love to invest in S&P 500 Index ETFs

Recommended by top investors

Warren Buffet, one of the best investors in the world, was famous for recommending an index fund approach, even for his own family.

John Bogle, who founded the Vanguard Group, made index investing affordable and available to everyday investors. His Book The Little Book of Common Sense Investing is a worldwide hit.

Reasons People love S&P 500 Index ETFs

- Passive Investing Strategy: You can get exposure to growth and dividends simply and without much effort—it’s an attractive strategy.

- Investors gain diversification and low-cost investing in a single purchase.

- The S&P 500 is the best indicator of the strength of the American Economy

- Many active Investors try to beat the market – but end up underperforming – “the market” usually refers to the S&P 500 and is often used as a benchmark for performance

- More affordable than purchasing individual shares of all companies.

- Many of the best personal finance books recommend a strategy of index investing.

The S and P 500 Index Historical Returns

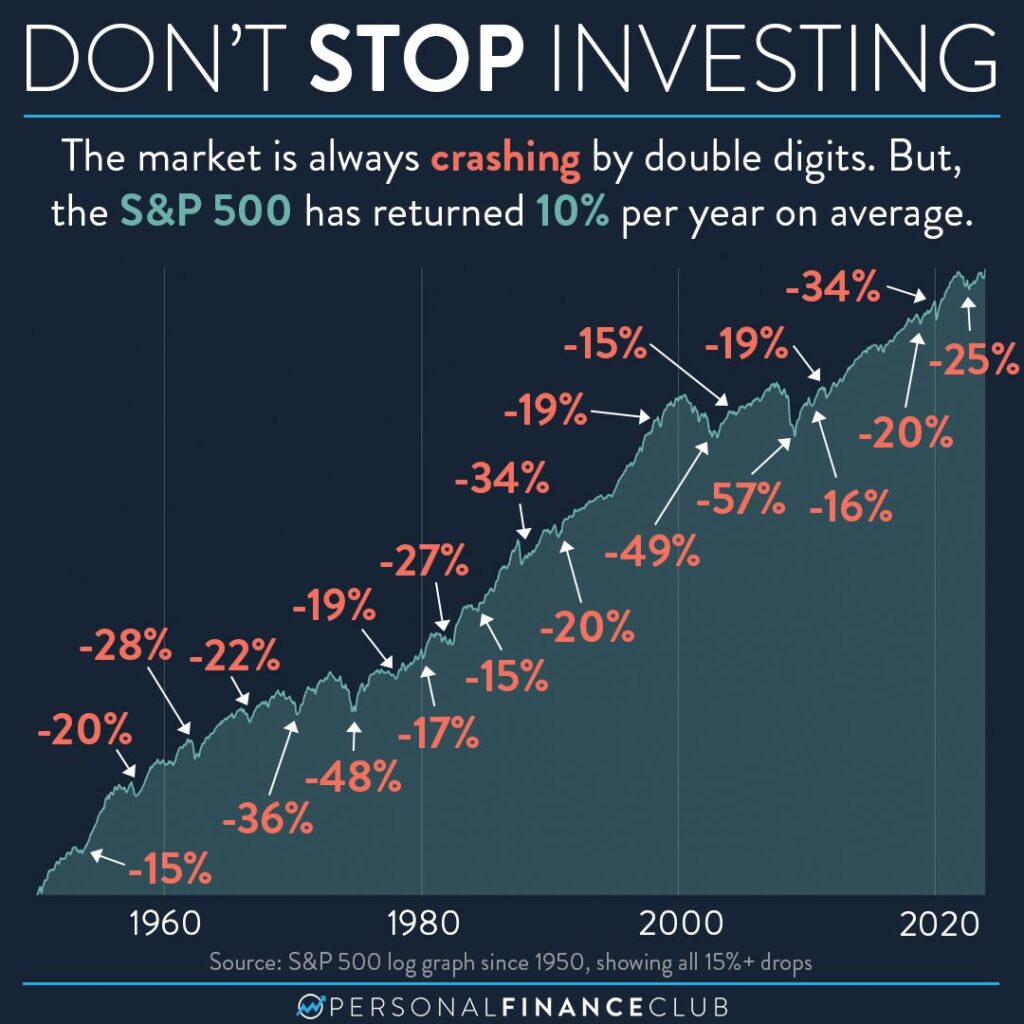

When investing, it is always important to remember that past performance is not an indicator of future performance. However, many people look to the average return of the S&P500 over time and use that as the benchmark for average stock market returns. On Average, the S&P 500 returns around 10 percent per year. This great chart by Personalfinanceclub.com shows the movement up and down, resulting in that 10% average.

This great chart from the Personal Finance Club shows the historical return over time, specifically focusing on the index’s dips or downturns. It shows it has still returned 10% on average, even in those bad years. Past performance never indicates future performance, but this track record gives people confidence.

How To Buy S&P 500 Index ETFs In Canada

The S and P 500 Index ETFs listed below are on the Toronto Stock Exchange. I am not here to tout the “best Canadian S&P 500 ETF” but to give you several options to research and decide for yourself as a starting point.

Before purchasing stocks or ETFs, you need to open a brokerage account, select your account type (TFSA, RRSP, etc.), and fund the account with a transfer from your bank account.

Do note that there are also ETFs from US stock exchanges that are not on this list—the most well-known ones are VOO: The S and P 500 Vanguard Index fund and IVV: iShares S&P 500.

Canadian S&P 500 Index ETFs

Here are six Canadian-listed S&P 500 Index ETFs for you to begin your research.

Some of these funds are CAD-Hedged. ETF Market Canada did a great article on whether Canadians should buy CAD Hedged or non-hedged funds. This issue can be confusing, but the article presents the ideas clearly.

Ticker Symbol: ZSP

Provider: BMO

Management Expense Ratio (MER): 0.09%

Dividend Yield: 1.24%

Quarterly Distributions

Unhedged

Ticker Symbol: ZUE

Provider: BMO

Management Expense Ratio (MER): 0.09%

Dividend Yield: 1.26%

Quarterly Distributions

CAD Hedged

Ticker Symbol: VFV

Provider: Vanguard Canada

Management Expense Ratio (MER): 0.09%

Dividend Yield: 1.16%

Quarterly Distributions

Unhedged

Ticker Symbol: VSP

Provider: Vanguard Canada

Management Expense Ratio (MER): 0.09%

Dividend Yield: 1.16%

Quarterly Distributions

CAD Hedged

Ticker Symbol: XUS

Provider: Blackrock iShares

Management Expense Ratio (MER): 0.09%

Dividend Yield: 1.3%

Semi Annual Distributions

Unhedged

Ticker Symbol: HXS

Provider: Global X (Formerly Horizons ETFs)

Management Expense Ratio (MER): 0.11%

HSX does not issue dividends

Unhedged

Should you buy an S&P 500 ETF listed in Canada?

We are Canadian and have Canadian dollars, so doesn’t it make sense to buy a Canadian-listed fund? After evaluating the options, it’s really a personal decision for your investment portfolio.

Three scenarios for S&P 500 Index ETF Purchase:

- Invest in a Canadian-listed Unhedged index ETF

Purchase with CAD - Invest in a Canadian-listed CAD Hedged Index ETF

Purchase with CAD - Invest in a US-listed Index ETF

- You should have a USD account or convert CAD to USD in your brokerage account (Currency exchange fees will apply).

- Investigate Norberts Gambit to avoid large conversion fees if your brokerage can facilitate it.

- Purchase the Shares from a US-listed ETF Provider.

Which Account Should You Buy An S&P 500 ETF In?

There are a few considerations to know before making this decision. US stocks are treated favourably in the RRSP account. Due to a treaty with the US, a 15% withholding tax on dividends is waived, whereas in the TFSA, the 15% withholding tax is applied.

Some people don’t particularly care about the withholding tax, especially if they are starting out and their dividends are fairly small. It won’t make that much of a difference initially, but over time, with larger portfolios, it can.

How To Invest In S&P 500 Index ETFs Today In Canada

So now that you know all this about the S&P 500 Index ETFs, how do you actually invest in them? Here is a simple six-step process to follow.

- Choose a Brokerage

- Open an account (TFSA, RRSP, FHSA, RESP, RDSP, RRIF, Non-Registered)

- Fund your brokerage account by transferring money from your bank

- Search and select your preferred S&P 500 index ETF of choice within your brokerage account

- Purchase your shares

- Repeat indefinitely on a regular basis

The Pros and Cons of Investing in the S&P 500

Pros of investing in S&P 500 ETFs

- Diversified across industries

- Low cost

- Simple – one purchase

- Investing in the best companies in the US

- Receive dividends

- Individual stock pickers have a hard time beating the market

- Poor performers get replaced when they no longer meet inclusion criteria.

Cons of investing in the S&P 500

- Tech Heavy

- Only US Companies – lack global diversification

- Whole index performance is often carried by a few companies

- No small or mid-cap stocks which can have substantial growth potential

- The most prominent companies in the country may have limited potential to grow further

Investing Research And Due Diligence

It is important to conduct thorough research and due diligence before investing in the S&P 500 Index or any stock in general. You can use tools that help you analyze stock performance to evaluate the financial performance, competitive positioning, and potential growth of the stocks or funds you are considering investing in. Understanding the costs, the provider, and the companies within the fund will help you make informed investment decisions and mitigate risk.

Final Thoughts

Purchasing shares of an S&P 500 Index fund is a great way to invest in the broad US market and gain access to investing in 500 companies for one single purchase price. Whether you choose US-listed or Canadian-listed funds in your TFSA, RRSP, or other account, you should evaluate the funds and how they may fit into your personal investing strategy.

Canadians often display a home country bias for the Canadian stock market and North American focus on their investments. Don’t forget to evaluate other funds that will also help you diversify outside the North American stock market.

This article is not financial advice; you should research whether investing in the S&P 500 is right for you.

If you want to join a community of investors online that discuss stocks and funds, pros and cons, and help new investors figure out what they are doing by sharing their portfolios and trades, join me on Blossom.

More From The Blog...

Why Wealthsimple Could Be the…

Wealthsimple Banking Review 2025: Best No-Fee Bank in Canada

Read More

Financial Reset For The New…

How to Do a Financial Reset for the New YearAs the new year begins, it's the perfect time to take...

Read More

The 5 Types of Financial…

Starting your journey towards Financial Independence Retire Early (FI/RE) in Canada opens up possibilities for those eager to take control...

Read More

In a Public Sector role?…

Public sector roles, including those in schools and hospitals, make up approximately 21% of employment in Canada. That includes teachers...

Read More

8 Canadian Investment Accounts To…

If you are new to investing, you might be wondering what the Canadian investment accounts are available, and which is...

Read More

What Are Canadian Real Estate…

Canadian Real Estate Investment Trusts: What They Are and Should You Invest? Canadians have heard owning property was the path...

Read More

6 Ways Fixing Credit Scores…

Struggling with debt can significantly impact your financial well-being, especially if your credit score suffers. Fixing credit scores is important...

Read More

The Paying Yourself First Method

Taking control of your financial future starts with a simple yet powerful concept: paying yourself first. Shifting your money mindset...

Read More

How to Calculate Retirement Savings…

When is a good time to calculate retirement savings needs? When retirement may be decades away it’s hard to think...

Read More

Different types of investments

There is a lot to understand about the different types of investments available in Canada. From the traditional options of...

Read MoreAbout The Author

Jessica Morgan

Jessica Morgan is the founder and CEO of Canadianbudget.ca. She is passionate about personal finance and helping Canadians improve their financial literacy by providing more Canadian focused financial content. A millennial mom of one, she has a burning obsession with all things personal finance.

Jessica has a BA in East Asian Studies from York University and a Masters in Business Administration from Toronto Metropolitan University. She is a career public sector employee with a Hybrid Pension, and an advocate for Canadian women to improve their personal finance knowledge.