How To Build Generational Wealth In 4 Steps

Table of Contents

ToggleBuilding generational wealth can feel impossible when dreaded financial struggles and living paycheck to paycheck feel like a never-ending cycle. But what if there was a way to break free from these chains and create long-lasting, generational wealth?

What does it mean to build generational wealth? It may look very different family by family. For some parents, it may look like getting their own financial affairs in order to ensure they aren’t a financial burden to their children later in life, giving their kids a clean slate. To others, it may mean building up wealth to a level where they can gift large financial sums to their kids and grandkids and have that wealth passed down from one generation to the next. Whatever way that looks like for you, it all starts with a solid foundation of financial literacy.

In this article, we will explore actionable steps to help you create a solid financial foundation that can benefit you and future generations, breaking financial curses and pushing your family toward prosperity.

Step 1: Learn Financial Literacy Skills to Build Generational Wealth(And Pass Those Learnings Along)

In order to build generational wealth, you first need to educate yourself and improve your own financial literacy. Without it, building a legacy for your family will be much harder. There are many ways you can start to improve your own financial literacy:

- Read Canadian finance blogs like this one

- Read personal finance books

- Take an investing course for beginners

- Listen to personal finance podcasts

- Watch Canadian finance Youtube Channels

- Seek unbiased financial advice from professionals

- Attend personal finance seminars and events

One of the most powerful ways to create long-lasting, generational wealth is by teaching financial literacy to future generations. Equipping your children or grandchildren with the knowledge and skills to manage their finances effectively empowers them to make informed decisions and build their wealth.

By teaching financial literacy to across your family generations, you create a legacy of economic empowerment and ensure that your family’s wealth is preserved and grown for years to come.

Start early by introducing basic financial literacy for kids from an early age. Teach them about budgeting, saving, and the importance of delayed gratification. As they grow older, they gradually introduce more complex topics such as investing, debt management, credit habits and entrepreneurship.

Lead by example and involve children in family financial discussions. This helps them understand the practical aspects of managing money and allows them to ask questions and seek guidance.

I get it, It is difficult to teach the younger generations when you may not be confident in it yourself.

The great news is there is an amazing virtual summit coming up specifically for parents who want to improve their financial literacy, learn how to build generational wealth, and teach their kids about finances so that wealth can be sustained across generations.

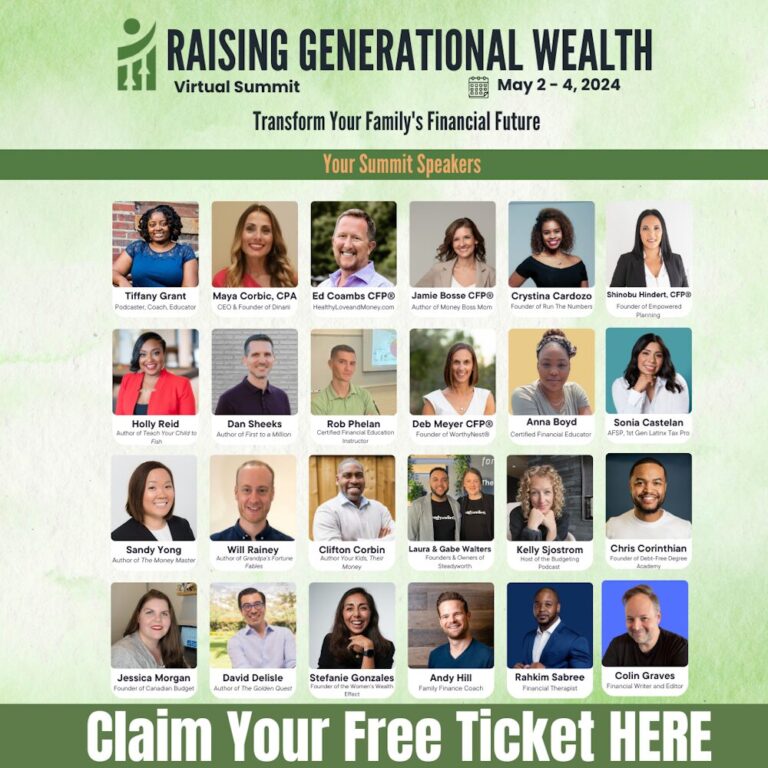

Introducing: The Raising Generational Wealth Virtual Summit

More than 20 amazing personal finance speakers are gathering at the Raising Generational Wealth Virtual Summit from May 2 – 4, 2024 to share wisdom on how you can build generational wealth, and endures it endures for future generations.

If your goal is to build generational wealth, you do not want to miss this! And best of all, you can get a ticket FOR FREE.

Just look at all these amazing session topics that help you build generational wealth and learn how to sustain it:

- Transform Your Money Mindset for Lasting Wealth and Legacy

- How Couples Can LOVE Talking Money

- Family First: The Importance of Estate Planning for Parents

- How to Become a Financial Role Model

- Blueprint For Financial Freedom: Building Your Financial Plan

- Smart Money Moves For Solo Parents

- Unlock Financial Success: A Proven Cash Flow Management System for Parents

- Getting Back To Basics With A Budget: Your Life, Your Paycheck

- How to Introduce Kids to Investing With Confidence.

- Unlocking Financial Independence Strategies for Youth

- Session: Raising Tomorrow’s CEOs : Cultivating Entrepreneurship in Kids

- Level Up Your Career & Income: From Paycheck to Portfolio

- Achieving Financial Independence and Wealth Building as a Family

- Securing Your Family’s Future: A Parent’s Guide to Retirement Planning

- Demystifying Investing: A Beginner’s Guide

- How to Pay for College Without Student Loans

- Equipping Parents to Raise Wealth-Conscious Children

- What’s your Awesome Stuff: Money Mindfulness for Kids and Parents

- Establishing Financial Boundaries

- Helping Kids Follow the 3 Rules of Wealth

- Tax Wisdom for Parenthood: Maximizing Benefits, Minimizing Burdens

- A Roadmap For Escaping the 9 to 5

- A Solution to Financial Stress: Cash Envelope Budgeting

And I will be contributing two sessions to the Raising Generational Wealth Summit

- Investing For Your Children Without Sacrificing Your Budget.

- Retirement Reimagined: Building Generational Wealth with Purpose

Step 2: Invest for Long Term Wealth Accumulation

The only way to grow wealth to the levels needed to sustain it for generations is to invest. Having an Investors Mindset helps you look toward your long term goals, and prevents you from being distracted by shiny overhyped meme stocks and FOMO.

Diversifying your investments can help protect your nest egg from large impacts from market dips. There are many ways to diversify: across asset classes, across geographies, across sectors, and between traditional and alternative investments.

Step 3: Diversify your income streams

Diversifying an investment portfolio to protect a nest egg is important. In addition, diversifying income streams can help protect that earning power over a lifetime. Relying on only one income stream is very risky, as if something happens to that one source of income, it could threaten future livelihood.

You’ve probably heard a quote about millionaires having 7 income streams. You don’t need 7 to create generational wealth for your family, but you likely do need more than 1 to make the process easier and more secure.

Income streams to build generational wealth:

1. Dividend income from an investment portfolio

2. Earned income from employment

3. Rental income from real estate

4. Royalties from artistic works, or inventions

5. Capital gains from selling assets

6. Business profits

7. Interest from savings, fixed income assets or other investments.

How many of these sources of income do you have today to accelerate your path to build generational wealth?

Step 4: Protect & Preserve Generational Wealth

You worked really hard to build generational wealth. Protecting and preserving it for future generations is important. Here are some strategies to consider:

Estate Planning:

Work with an estate planning attorney to create a comprehensive estate plan that includes a will, trusts, and other legal documents. This ensures that your assets are distributed according to your wishes and minimizes the tax burden on your heirs.

Asset Protection:

Consider structuring your assets to protect them from potential risks or liabilities. This could include setting up trusts, companies, or establishing other protections.

Insurance:

Review your insurance policies regularly to ensure adequate coverage for your assets and liabilities. This includes life insurance, disability insurance, and liability insurance.

Regular Reviews:

Review your financial plan and investments to ensure they align with your goals and risk tolerance. This allows you to make necessary adjustments and stay on track towards long-term wealth preservation.

By implementing these strategies, you can protect your generational wealth and ensure it continues growing and benefits future generations.

Build Generational Wealth That Lasts

When you’ve worked so hard to build generational wealth, ensuring it lasts for more than just your own lifetime is an endeavor that takes education, support, focused efforts and a great plan. Start by learning from experts in personal finance and grab a ticket to the Raising Generational Wealth Summit today!

About The Author

Jessica Morgan

Jessica Morgan is the founder and CEO of Canadianbudget.ca. She is passionate about personal finance and helping Canadians improve their financial literacy by providing more Canadian focused financial content. A millennial mom of one, she has a burning obsession with all things personal finance.

Jessica has a BA in East Asian Studies from York University and a Masters in Business Administration from Toronto Metropolitan University. She is a career public sector employee with a Hybrid Pension, and an advocate for Canadian women to improve their personal finance knowledge.