The TFSA (Tax-Free Savings Account) is one of Canadians’ most misunderstood financial tools. Introduced in 2009, it is a versatile financial tool to help Canadians build wealth TAX FREE!

This article will discuss why Canadians are so confused about whether they should be saving or investing in a TFSA, what the best use of the TFSA is, and how you can get started. Increasing your financial literacy is essential for all Canadians.. Learning more about the options available for Canadians to build wealth is an excellent step in the right direction!

What is the 2024 TFSA contribution limit?

Table of Contents

ToggleThat question is probably on a lot of people’s minds right now. Canadians over 18 can use this account to save and invest for their short—or long-term goals through investment or savings accounts.

TLDR: the 2024 TFSA contribution limit is $7000, but you want to read on to make sure you don’t make these common mistakes.

Why Do Canadians Misunderstand The TFSA contribution limits and the account itself?

The Tax-Free savings account in Canada is one of the BEST accounts for building wealth, but it’s also one of the more misunderstood accounts. Let’s explain why you may not be using your TFSA to its full advantage and what you should be doing instead.

First of all, it’s not Canadians’ fault that many are using the TFSA in a way that is less than ideal. The primary issue comes from its name. It is called a Savings Account, but the way to get the most value is by using it as an investment account.

TLDR: the 2024 TFSA Contribution limit is $7000, but you want to read on to make sure you don’t make these common mistakes.

Let’s think about the main benefit this account provides. It is a Tax Free account, which means your money grows tax-free, and is not taxed on withdrawal. You are using your after-tax dollars to contribute, so there are no deductions in taxes like you could get when you contribute to your RRSP. To understand why this is so important, let’s take a step back.

When Are We Taxed in Canada?

Here in Canada, among other things, we are taxed when we make income. When it comes to savings and investment, that can be one of three ways.

- Interest Income

- Capital Gains

- Dividends

When saving money in a savings account, it is common to earn some level of interest on our balances. Depending on your financial institution, the interest rate of your TFSA Savings account could vary widely. Unfortunately, most TFSA savings accounts are NOT high-interest savings accounts.

However, since interest rates have risen, some institutions provide higher rates for TFSA Savings accounts. If you want to earn interest by saving (and not investing), a TFSA account is not your best bet. There are some great rates in High-Interest savings accounts, which are taxable. If you are looking for a High-Interest savings account that pays you a high everyday interest rate consider this one.

Tax Free Savings Account vs High Interest Savings Account

A HISA is a High-Interest Savings account that is taxable. Some people are afraid to use a HISA account for savings because they are so tax-averse that any thought of incurring taxation gets their anxiety on high alert. We live in Canada; we pay taxes; it’s a fact of life.

Trying to avoid taxes by intentionally choosing to earn less interest is like trying to avoid getting a raise because it may bump your tax bracket. Earning more money is always worth it. Don’t shortchange yourself; you will still come out ahead.

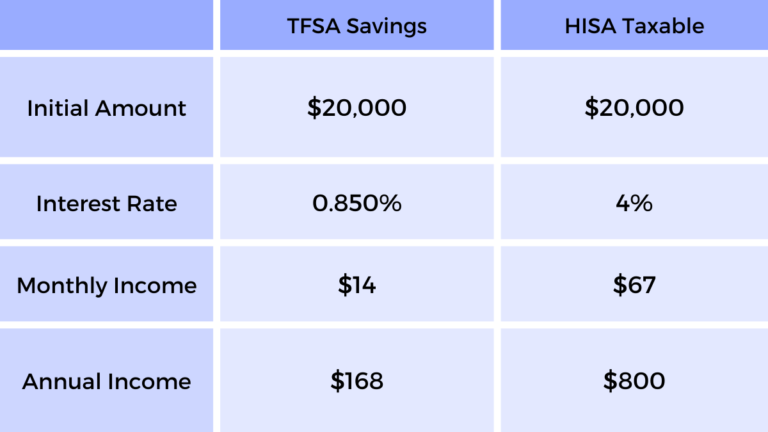

A TFSA savings account earning you .85% Would net you $168 in interest in one year. While the HISA Account would make you $800 in interest. You can see how much of an advantage the taxable HISA account gives you in earning power over the low-interest TFSA savings account.

In a taxable account like a HISA, the interest income you make from a savings account will be reported for taxes. This is why the institution will ask for your tax information when you open an account. “Each year, your financial institution will send you a Statement of investment income (T5). You must submit it along with your personal income tax return. A T5 shows how much investment income you earned for a given tax year.”

Even if you are taxed on the HISA account, you will still come away with more money than saving at a much lower rate in a tax-free account. Honestly, the taxable interest from a savings account is not going to move the needle so much that you would come away with a big tax bill to outweigh the amount of additional income you are receiving. So please don’t be afraid to use a HISA.

High Interest Savings accounts do have their place – short-term savings and emergency funds are two great uses for high interest savings accounts.

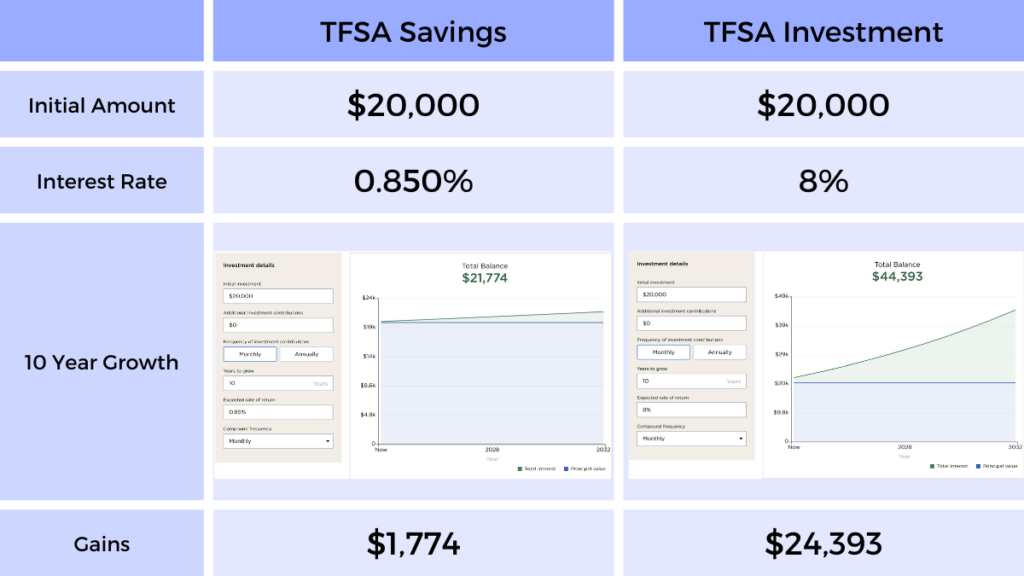

The Savings account earning you a measly 0.85% would net you a gain of $1,174 over a ten year period, while the investment account would be growing at around 8% and up $24,393!

* Investment returns are never guaranteed. There is risk in all investments. Previous return is no guarantee of future return. Calculated with Nerd Wallet’s investment calculator

With the above comparison, starting with the same amount and not making any further contributions, the investment account would put us over $23,000 ahead of our savings account.

On top of that, in ten years, our savings account has also lost value as our purchasing power erodes with inflation, further driving home that to grow our wealth, we NEED to be investing!

Should I save or Invest in a TFSA

The answer to this is even more important than figuring out the TFSA limit for 2024. The answer is that you should be investing in a TFSA Account! When you invest, you give your money a chance to grow exponentially.

Investments can appreciate and earn dividends, which, when reinvested, help you grow your portfolio much quicker. Investing can be scary if you are not familiar with it.

That’s why we created a course to help Canadians learn the basics around investing – demystifying it to make it more accessible to more people.

Can I use TFSA for Investing AND saving?

You can hold multiple TFSA accounts of similar or different types. Note that the contribution room total is for you as an individual and not per account, so be mindful of tracking your contributions if you have multiple accounts. If you must open a TFSA savings account, which If you’ve read this far, you know I would not recommend that you waste your 2024 TFSA limit in a savings account. But if you have to, please choose the highest everyday interest rate possible (don’t get sucked in by a short-term promotional rate). Check out some options here as rounded up by NerdWallet.

What’s wrong with using a savings account TFSA in addition to a TFSA investment account?

You use your valuable contribution room for a much less impactful purpose. Each account has its best use. A High-interest savings account is best for keeping cash for short-term goals or emergency funds; A TFSA is best used for investing so you can grow your nest egg for the future TAX-FREE. We won’t benefit from favourable tax treatment on a small savings account like we would on an extensive and growing investment portfolio. So, to put the account to the best benefit for you, you should be investing in your TFSA Account.

How limits for TFSA/TFSA Contribution Room Works

Before you contribute or withdraw from your TFSA account, you need to understand the TFSA limit for 2024 and how the contribution room works in this account. Each year, you have a set amount that you can contribute to your TFSA accounts. A new limit is set each new year – These annual limits are cumulative—they add to your room each year.

Also, if you withdraw from your TFSA account, you can add back that same amount (plus your annual limit) in the next year. If you decide you want to put that money back in the same year – you can only do so if you have that much contribution room available for that year.

2024 TFSA Contribution Limit & Total TFSA Contribution Room

The TFSA limit in 2024 will be set at $7,000. The annual contribution limit changes from year to year. It is “indexed to inflation and rounded to the nearest $500.” This is another area which is widely misunderstood. Some people take the annual limit as the maximum and misunderstand their total contribution room. Let’s clarify this misconception.

Most people I know have never maxed out their Total TFSA Account Contribution limit – but restrain themselves to thinking only about the annual limit.

But get this: If you were at least 18 years old when the TFSA was introduced in 2009, and you never contributed before, as of January 1st, 2024, you will have a total of $95,000 in contribution room that you can use.

So what do you think your real TFSA limit 2024 is, taking this information into account?

Year | Limit | Year | Limit |

2024 | $7,000 | 2016 | 5,500 |

2023 | $6,500 | 2015 | $10,000 |

2022 | $6,000 | 2014 | $5,500 |

2021 | $6,000 | 2013 | $5,500 |

2020 | $6,000 | 2012 | $5,000 |

2019 | $6,000 | 2011 | $5,000 |

2018 | $5,500 | 2010 | $5,000 |

2017 | $5,500 | 2009 | $5,000 |

If you contributed (and withdrew) from your account over the years since opening your TFSA, you must check your My CRA Account to confirm your specific contribution room. It’s important to check because over-contributing will lead to financial penalties. “At any time in the year, if you contribute more than your available TFSA contribution room, you will have to pay a tax equal to 1% of the highest excess TFSA amount in the month for each month that the excess amount stays in your account.”

Want to learn more about investing in Canada?

If you want to improve your financial literacy and build investing knowledge, download this FREE cheat sheet on the Top Ten Terms to learn about investing in Canada and build the confidence you need to start investing. It is so important to continue to pursue financial education in whatever format is preferable to you. Whether through books, enrolling in a course, or following more Canadian Money influencers on your social media!

Doing the TFSA right!

The TFSA account is the BEST tool Canadians have to build wealth. It allows us to grow our nest egg with tax-free growth and withdrawals. The way we utilize this tool in the most impactful way is by using it to invest, not save. Now you know the 2024 TFSA contribution limit, and why you may be able to invest more than that next year.

The High-Interest Savings Account has its place, and that is to help you reach your short-term financial goals and store your emergency fund! HISA’s are not scary! Don’t be so afraid of taxes that you prevent yourself from making more money!

Every eligible Canadian should open a TFSA investing account. Anyone over 18 can start investing in a tax-free savings account and reap the benefits of long-term growth in their investment portfolio. The earlier you begin investing, the better! Not everyone can max out their TFSA accounts each year, and that’s ok! Contribute consistently and plan for the long term, increase your contributions over time when you can, and the TFSA Investment account will help you reach your financial goals.

You should consult with a financial advisor and/or conduct further research to make well-informed decisions about using a TFSA account for investing. If you need help I recommend finding a fee-based or Advice-only financial planner.

Read more from the Canadian Budget Blog

Do You Need an Accountant…

Guest Post by Karan Sachdeva of MultiTaxServices Doing taxes in Canada Money management often feels like one of those “I’ll...

Read More

Why Wealthsimple Could Be the…

Wealthsimple Banking Review 2025: Best No-Fee Bank in Canada

Read More

Financial Reset For The New…

How to Do a Financial Reset for the New YearAs the new year begins, it's the perfect time to take...

Read More

The 5 Types of Financial…

Starting your journey towards Financial Independence Retire Early (FI/RE) in Canada opens up possibilities for those eager to take control...

Read More

In a Public Sector role?…

Public sector roles, including those in schools and hospitals, make up approximately 21% of employment in Canada. That includes teachers...

Read More

8 Canadian Investment Accounts To…

If you are new to investing, you might be wondering what the Canadian investment accounts are available, and which is...

Read More

What Are Canadian Real Estate…

Canadian Real Estate Investment Trusts: What They Are and Should You Invest? Canadians have heard owning property was the path...

Read More

6 Ways Fixing Credit Scores…

Struggling with debt can significantly impact your financial well-being, especially if your credit score suffers. Fixing credit scores is important...

Read More

The Paying Yourself First Method

Taking control of your financial future starts with a simple yet powerful concept: paying yourself first. Shifting your money mindset...

Read More

How to Calculate Retirement Savings…

When is a good time to calculate retirement savings needs? When retirement may be decades away it’s hard to think...

Read MoreAbout The Author

Jessica Morgan

Jessica Morgan is the founder and CEO of Canadianbudget.ca. She is passionate about personal finance and helping Canadians improve their financial literacy by providing more Canadian focused financial content. A millennial mom of one, she has a burning obsession with all things personal finance.

Jessica has a BA in East Asian Studies from York University and a Masters in Business Administration from Toronto Metropolitan University. She is a career public sector employee with a Hybrid Pension, and an advocate for Canadian women to improve their personal finance knowledge.

Jessica Morgan

Jessica Morgan is the founder and CEO of Canadianbudget.ca. She is passionate about personal finance and helping Canadians improve their financial literacy by providing more Canadian focused financial content. A millennial mom of one, she has a burning obsession with all things personal finance.

Jessica has a BA in East Asian Studies from York University and a Masters in Business Administration from Toronto Metropolitan University. She is a career public sector employee with a Hybrid Pension, and an advocate for Canadian women to improve their personal finance knowledge.