The By-Hand Budget for the Digital Spender

Table of Contents

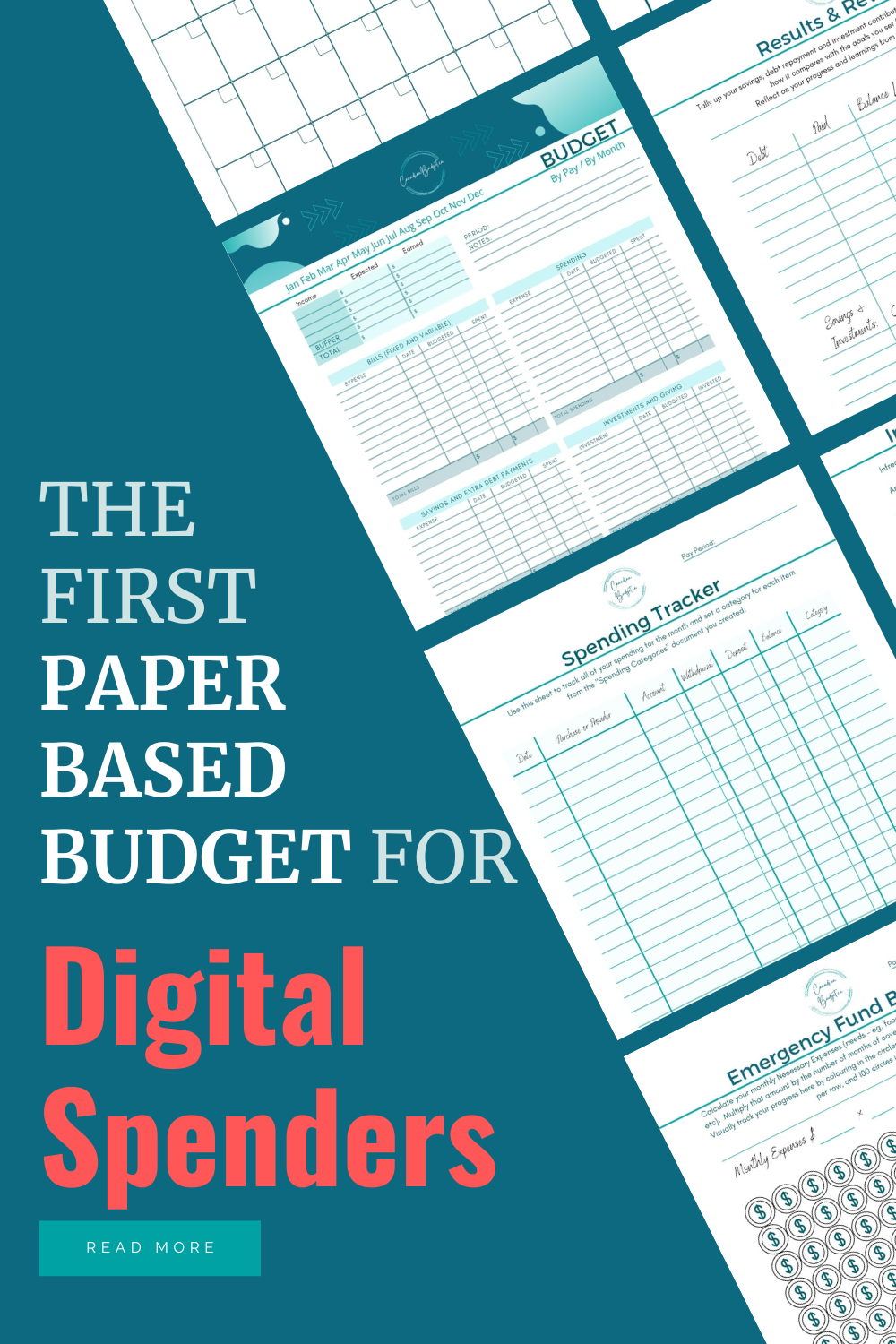

ToggleAre you a digital spender looking for a budget planner that fits their style?

Someone who doesn’t use cash unless absolutely necessary? A credit card point collector, or just someone who no longer wants to use cash and prefers debit or credit.

Have you ever wanted to have a paper based budget planner, but were frustrated that all the budget planners you could find were focused on using cash as the main method of spending?

I was looking for a new budget planner to use when I started my maternity leave. My income changed with my leave, and I really needed to drill down on my spending and budgeting, so I made the switch to paper based, or budgeting by-hand.

After searching everywhere, I couldn’t find a printable budget planner that suited my cashless spending style. All the printable budgets were based on the cash envelope system. For non-cash spenders, it just doesn’t fit, so the Canadian Budget Planner was born to fill this gap. I believe it to be the first paper based budget for digital spenders.

The Canadian Budget Planner has been in the works for months now and it’s ready to go! I am so excited to share with you a little bit about what you can find in the Canadian Budget Planner.

By the way, you definitely do not have to be a Canadian to use this product, it is universally applicable.

You can buy it now or scroll down to learn more and get a sneak peek at a few of the documents!

What’s in the Budget Planner?

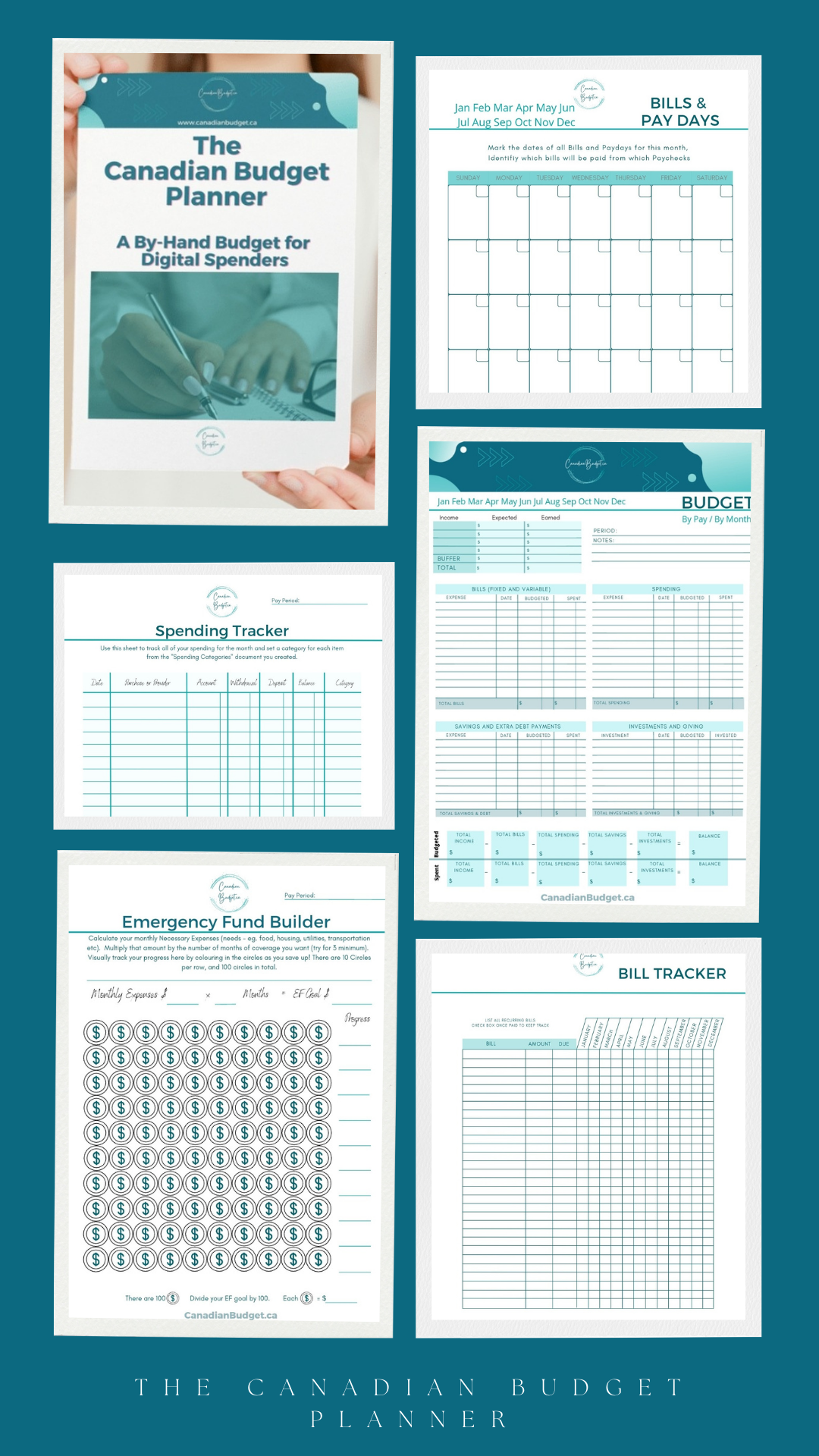

The Canadian Budget Planner is a financial management system to help you get out of debt, set and reach financial goals, plan for infrequent and unexpected expenses, Save for an emergency fund, Set a budget, track your spending, reflect and learn and more!

This Budget Planner is way more than just a budget. It includes 3 sections with an incredible 14 documents in total to help you get your financial life in order! Use selected parts as needed, or utilize the whole budget planner to suit your needs!

Section 1: Preparation Work & Annual Documents

- Financial Goal Setter

- Bill Tracker

- Debt Tracker

- Debt Payoff Planner

- Infrequent Expenses

- Emergency Fund Builder

- Identifying Spending Categories

Section 2: Start of Month Documents

- Bills & Pay Days Calendar

- Core Budget

- Expense Tracker

- Category Spending Tracker

Section 3: End of Month Documents

- Results & Review

- Debt Payoff Progression

- Savings Tracker

Sounds interesting?

I’m so excited to launch this product, and I hope you are excited to learn more about this budget planner!

The best way to move forward with your finances is to know where your money is going, track what is due, and make a goal for you to move toward. This awesome tool lets you take control of your finances and build wealth!

If you want to start with a budget planner that can change your financial future, Start here!

Tag us on social media @CanadianBudget and use the hashtag #CanadianBudgetPlanner We would love to see how you use the product to rock your own budget!

Read more like this from the Budgeting Section of the Blog.

About The Author

Jessica Morgan is the founder of canadianbudget.ca and a Millennial mom of one who has a burning obsession with all things personal finance. Jessica has a BA in East Asian Studies from York University and a Masters in Business Administration from Toronto Metropolitan University. She is a career public sector employee with a Hybrid Pension, as well as an advocate for Canadian women to improve their personal finance knowledge.

More from the blog...

The 5 Types of Financial…

Starting your journey towards Financial Independence Retire Early (FI/RE) in Canada opens up possibilities for those eager to take control...

Read More

In a Public Sector role?…

Public sector roles, including those in schools and hospitals, make up approximately 21% of employment in Canada. That includes teachers...

Read More

8 Canadian Investment Accounts To…

If you are new to investing, you might be wondering what the Canadian investment accounts are available, and which is...

Read More

What Are Canadian Real Estate…

Canadian Real Estate Investment Trusts: What They Are and Should You Invest? Canadians have heard owning property was the path...

Read More

6 Ways Fixing Credit Scores…

Struggling with debt can significantly impact your financial well-being, especially if your credit score suffers. Fixing credit scores is important...

Read More

The Paying Yourself First Method

Taking control of your financial future starts with a simple yet powerful concept: paying yourself first. Shifting your money mindset...

Read More

How to Calculate Retirement Savings…

When is a good time to calculate retirement savings needs? When retirement may be decades away it’s hard to think...

Read More

Different types of investments

There is a lot to understand about the different types of investments available in Canada. From the traditional options of...

Read More

Is the 50 30 20…

Is The 50 30 20 Budget Method Right For You? Is the 50 30 20 Budget Method Right for You?...

Read More

Presidents Choice Financial Mastercard: Review

Presidents Choice Financial Mastercard Review Should you consider the Presidents Choice Financial Mastercard? It is an excellent option if you...

Read MoreAbout The Author

Jessica Morgan

Jessica Morgan is the founder and CEO of Canadianbudget.ca. She is passionate about personal finance and helping Canadians improve their financial literacy by providing more Canadian focused financial content. A millennial mom of one, she has a burning obsession with all things personal finance.

Jessica has a BA in East Asian Studies from York University and a Masters in Business Administration from Toronto Metropolitan University. She is a career public sector employee with a Hybrid Pension, and an advocate for Canadian women to improve their personal finance knowledge.